Younger Americans are finding today’s economy hard to navigate, as the labor market shrinks and prospects for homeownership dwindle. As a result, many of them are sinking what cash they have in budding betting markets for a potential quick boost in income.

While they hustle their way through life, analysts point out that life isn’t as bad for older Americans.

Christopher Lagana and James Denaro work on the floor at the New York Stock Exchange in New York, Friday, Jan. 9, 2026. (AP Photo/Seth Wenig)

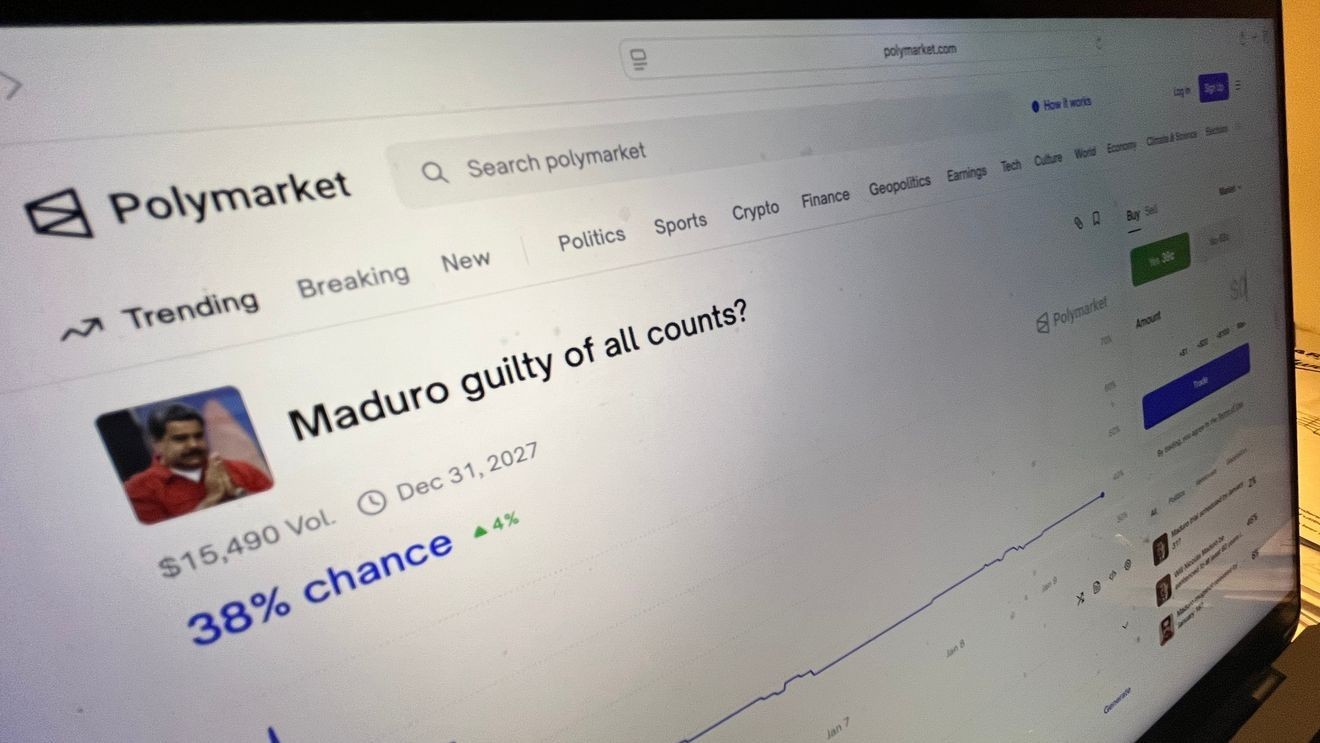

Online financial platforms are filling the demand for younger generations who are leaning in on gambling and cryptocurrency markets for a path to the American dream. Two of the biggest are prediction platforms Kalshi and Polymarket. Both are aiming to financialize as much of normal, everyday life as possible.

“The long term-vision is to financialize everything and create a tradable asset out of any difference in opinion,” Kalshi CEO Tarek Mansour said at a business event last month. He believes that his platform is offering the opportunity for clarity on any given news event.

Betting has become nearly frictionless, as smartphones now offer up chances to take place wagers on all manner of life. That’s turned the gambling industry into one of the fastest growing sectors in the U.S. in terms of GDP growth, according to a recent Bureau of Labor Statistics report.

Despite going all-in on these platforms, there is evidence younger Americans — especially men — are not happy about the role gambling plays in American life. Men under 30 are more likely today than in 2022 to view sports betting as bad for society, a Pew Research poll found last August.

About 47% of men in that category looked negatively at the industry today. Back in 2022, that number was just 22%, according to Pew. The numbers were similar for other age groups, though the biggest shift in views came from younger men.

The economic stress of climbing the ladder and carving out a family is intense, especially for younger people hoping to buy a home who are sifting through the market during a large housing shortage.

One estimate from the Erdmann Housing Tracker shows the country is short by as many as 15 million to 20 million units, which is pushing prices up and leaving many younger would-be homebuyers on the sideline. That’s leading to 22% of Millennials giving up on purchasing a home, according to a recent Bankrate survey.

The shortage began in the 1970s, when housing starts dipped from 50,000 per one million people to a little more than 40,000 during the next 30 years. Construction starts plummeted to just over 21,000 per million people in the aftermath of the Great Financial Recession.

The older generation is partially to blame for the pinch in the housing market, as Americans in their retirement years vote to rezone property.

A Boston University study in 2018 of planning and zoning board meetings in Boston found that more than 60% of people submitted comments opposed to new housing development, while only 15% voted in favor. The average age of the commenter was 58. The average age of voters in the U.S. is over 50.

Americans who have paid-off mortgages, and baby boomers with large retirements, are propping up most consumer spending, while the top 10% of households by income now make up more than half of aggregate expenditures. Low and middle-income Americans are struggling to keep up.

A “For Sale” sign is displayed in front of a home in Prospect Heights, Ill., Monday, Dec. 15, 2025. (AP Photo/Nam Y. Huh)

Part of the reason has to do with continued income tax cuts that benefit mainly the wealthy, economists argue.

“The combination of income tax cuts and tariff increases is a regressive fiscal switch that moves the tax burden down the income distribution, away from the well-off and towards poorer members of society,” economist Kimberly Clausing wrote last September in the Center for Economic Policy Research.

Trump’s tariffs and tax cuts are contributing to the barriers, as well.

This is paving the road to what podcaster and financial analyst Demitri Kofinas has coined “financial nihilism” — or the belief that the system is rigged in the favor of either the wealthy or older generations who benefited from an economic era of affordable prices and low interest rates.

Economic commentator Kyla Scanlon told CNBC last year that young Americans have determined that if the game is rigged, then “you might as well just gamble it away,” given that the “traditional economic ladder is increasingly out of reach.”

Other analysts believe it’s likely impacting how Americans think about family generation. This is a view shared by financial analyst Michael Green, who argued in an article last year that the poverty line for a family of four is closer to $140,000 per year rather than the official $32,000.

At the time, Green cited many factors for the increase, including housing costs and the price of childcare, which became a serious burden as women entered the workforce to supplement family income.

Green told The National News Desk that the economy is not making it easier to create a family, and it’s that stress which could result in negative social outcomes. Scuffling along without being able to achieve any meaningful financial success prompts Americans to ask their spouses hard questions about whether a family is possible.

Green said they sometimes come to the conclusion that they have “failed at the game of life. That makes people angry, and I don’t blame them.”